Contents

Cement Industry in Bangladesh

[wpecpp name=”package + Updates forever” price=”250″ align=”center”]

Executive Summary

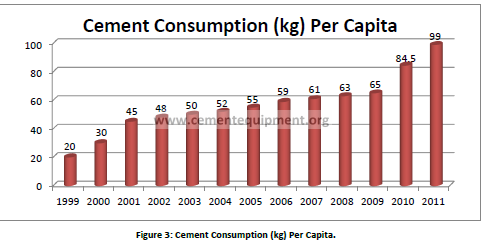

Bangladesh cement industry is the 40th largest market in the world. Currently capacity of the industry is about 20 mn tonnes (MT). Top 13 players are alone controlling over 78% of the total industry capacity. However, the balance capacity still remains quite fragmented. Per capita consumption remains poor when compared with the world average; only 99 kg (FY2011) while our neighboring countries, India and Pakistan, have per capita consumption of 135kg and 130kg respectively. Many countries cannot produce enough cement to meet their internal demand, and they depend on imports. However, Bangladesh is self-sufficient in fulfilling local demand for cement. Even so, the installed production capacity is higher than local demand.

In Bangladesh, there are around 55 cement-manufacturing companies, most of which are in operations either on a large or small scale. A total of 34, including multinational cement manufacturers, are in commercial production.

The installed production capacity of the 34 cement factories is 1.85 crore tonnes a year, according to Bangladesh Cement Manufacturers Association (BCMA) data. Some remarks should be mentioned:

1. The cement industry is likely to maintain its current growth momentum and continue growing at around 20% to 25% in the medium to long term. Government initiatives in the infrastructure sector and the housing sector are likely to be the main growth drivers.

2. Our cement consumption per year was only 65kg in FY2009 whereas, in India its 135 kg and in Pakistan its 130kg. So there is a lot of opportunity to grow in this industry.

3. If the import duty structure of various cement products, e.g. finished cement, semi-finished cement and basic raw materials for cement (25%, 12% and 7% respectively) continues i.e. import duties is on favor of the local manufacturers and the construction sector remains booming with smooth power supply than nothing to be surprised that cement industry will be the most evolving industry in the next three to five years.

4. The importance of the housing sector in cement demand can be gauged from the fact that it consumes almost 60%-65% of the country’s cement. If housing sector growth wanes, it would impact the growth in consumption of cement, leading to demand supply mismatch.

1. Introduction

1.1. Origin of the report

The report has been undertaken as a part of our fulfillment of a course named Business Communication in MBA, IBA Jahangirnagar University. Conducting such an assignment has given us a rare opportunity to blend my theoretical knowledge with practical aspects.

Assignment of such a report to be conducted under the auspicious guidance of our course instructor, Mr. Arafat Rahman, one of the honorable faculties of the Department of IBA has set the stage to conduct the report.

1.2. Background of study

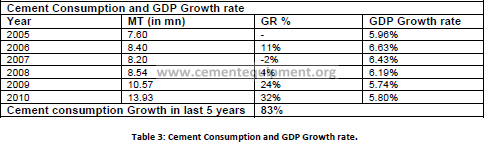

Development of cement industry in Bangladesh dates back to the early-fifties but its growth in real sense started only about a decade. The country has been experiencing an upsurge in cement consumption for the last five years.

Government gave permission for establishing cement industries in Bangladesh in FY1995. Initially the cement industry took place without the proper analysis of the demand and supply of cement in the country. Within the span of the two to three years, industry attained expanded capacity of the product with stable growth rate of consumption.

There were mainly four dominant players in the cement industry in the year 1998 that produced their own cement to meet the demand of their customers. These companies were: Meghna Cement, Eastern Cement, Chatok Cement and Chittagong Cement.

After a decade, currently 123 companies are listed as cement manufacturers in the country. Among them 63 have actual production capacity while 32 are in operation. The current installed capacity of the industry is 20.0 mn MT.

1.3. Scope of the report

The scope of the report is defined by the extensiveness of the issues and facts covered in a research. In this report a wide array of attention has been given to different facts, studies, articles, journals related to the cement sector. The report confines its scope within regional cement industry, comparing with the other countries. More specifically the scope of the report can be presented in the following lines:

• To understand about the Cement Industry of Bangladesh

• The analyze the current scenario of overall Cement Industry of Bangladesh

• Global Scenario of Cement Industry.

1.4. Sources and Methods of Data Collection

The Methodology of the study is to collect data, processing the data in a very systemic form so that it can be possible to predict something about the company based on the analysis. Data can be collected both from primary level and secondary level. But this is true that primary data collection is much more difficult due to time constraints and the information is sometimes confidential to the company itself.

To conduct the project the following sources have been used.

– Primary Information: The primary source of information is based on the collecting reports of different cement company in Bangladesh.

-Secondary Information: The secondary source of information is based on Internet Searching, Annual report of different cement company in Bangladesh.

1.5. Benefit of study

The analysis in the project part is based on Cement Industry in Bangladesh. In a word this report will give a short scenario of Cement Industry in Bangladesh as well as cement industry in the world. We hope this report will be helpful for the students who have interest to work on Cement Industry.

1.6. Definition and Acronyms

ASM = American Standard Method

BCMA= Bangladesh Cement Manufacturing Association

CNF = Cost & Freight

ESM = European Standard Methods

OPC = Ordinary Portland Cement

PCC = Portland Composite Cement

UNFPA = UN Population Fund

1.7. Limitations

The report has certain limitations, which must be mentioned for the sake of reader’s understandability and achieving transparency. As most of the data were taken from the web sites, though the cross check was conducted; still the depth of reliability varies as by the nature of web sites. For data, most of the data used in this paper are government published data, so the verification of this data was not possible. Lastly the limited knowledge of the analyst, who is conducting such report for the first time, has its effect on the paper. Most of the figures are drawn by the help of Microsoft excel by using the data from various source, so human error can be possible.

2. Cement Industry Overview

2.1. Introduction

The development of cement industry in Bangladesh dates back to the early-fifties but its growth in real sense started only about decade or so. Bangladesh has been experiencing an upsurge in the use of cement in recent years. Increase in demand for cement has soared mainly due to the property sector boom and infrastructure development concentrated in the Dhaka Metropolitan area and other major urban areas of the country. The infrastructural development at grass root level has led to an increased demand for cement at an average rate of 8% per annum during the past decade.

2.2. Background of Industry

Development of cement industry in Bangladesh dates back to the early-fifties but its growth in real sense started only about a decade. The country has been experiencing an upsurge in cement consumption for the last five years.

Government gave permission for establishing cement industries in Bangladesh in FY1995. Initially the cement industry took place without the proper analysis of the demand and supply of cement in the country. Within the span of the two to three years, industry attained expanded capacity of the product with stable growth rate of consumption.

There were mainly four dominant players in the cement industry in the year 1998 that produced their own cement to meet the demand of their customers. These companies were:

After a decade, currently 123 companies are listed as cement manufacturers in the country. Among them 63 have actual production capacity while 32 are in operation. The current installed capacity of the industry is 20.0 mn MT.

2.3. Current Scenario of the industry

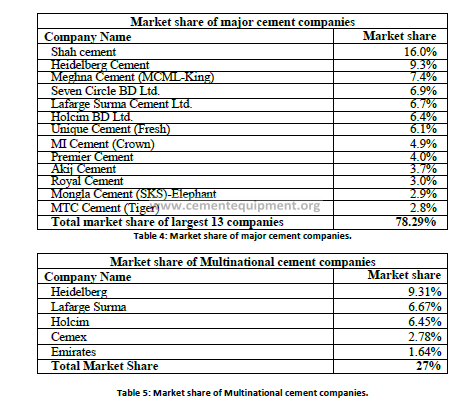

Currently, multinational cement companies are facing intensive competition with local companies. Lafarge, Cemex, Holcim and Heidelberg are among the top ten cement companies in the world, but together they make up only around 27% of the Bangladesh market.

Scancement of Heidelberg Group is the biggest among the foreign companies, but its market share is around 9.3% despite it has been in Bangladesh for nearly a decade. Holcim’s market

share is around 6.4% despite it bought three plants in quick succession more than half a decade back as it planned to emerge as the top player in the country. Lafarge and Cemex, the world’s first and the second largest cement companies have been struggling to survive in the industry.

Local companies are grabbing the top slot of the industry by operating in economy of scale and with deft marketing strategy. For example, Shah Cement, a subsidiary of the country’s biggest conglomerate Abul Khaer Group is now in the top of the industry beating Heidelberg and Holcim by deploying a fleet of trucks in the main growth areas and building the best marketing network in the country.

Local companies are investing in backward linkages (captive power plants), have built big plants to reduce cost of production and have a fleet of trucks to carry the products right to the doorsteps of consumers. Quality-wise also, the local companies have made rapid strides.

Multinationals bear high overhead costs regarding salary, infrastructure, quality control etc. On the other hand, local companies are more focused to keep the overhead costs low. Multinationals are only concentrating in providing high quality products. But local comapanies are concetrating in offering quality product with additional benefits like home delivery system, rebate, gifts etc.

Local manufacturers have been pursuing more innovative and agressive business strategy compared to multinationals. Local manufacturers seek to seize large market by reaching mass people through economies of scale while multinationals cater the needs of specific group of customers by charging high price through superior brand value and quality.

2.4. Cement industry: Global Scenario

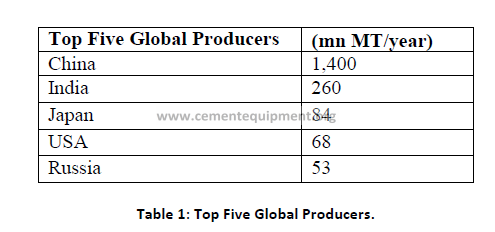

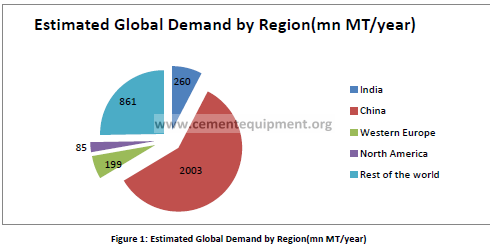

World production of cement was 2.6 billion tons/year (FY2011). The world production of cement is dominated by China (1,400 mn MT), followed by India (260 mn MT), United States, Japan and Russia. China and India, together account for more than 50% of the total cement produced and consumed in the world. Developed markets including the US, Western Europe and Japan are mature and currently facing declining demand due to the global economic crisis.

A number of developing countries in the Asia/Pacific region are attaining strong gains in cement consumption. China, which accounts for nearly half of world cement demand, is facing a slowing rate of growth as construction spending is decelerating.

The largest global players are Lafarge (France), Holcim (Switzerland) and Cemex (USA). In terms of cement production, Bangladesh ranks about 40th in the world.

According to Global Industry Analysts, Inc., global demand for cement is forecasted to rise 4.1% per year and reach to 3.5 billion metric tons in 2013. Gains will be fueled by rising investments in infrastructure among the developing countries of the world, driven by economic growth and increasing per capita income levels.

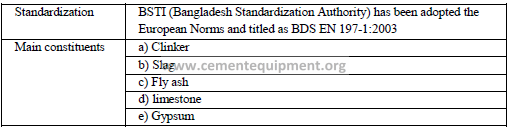

3. Product and Technology

Till 2002, only one type of cement was available in Bangladesh was Ordinary Portland Cement (OPC) which is made following the American Standard Method (ASM). From the year 2003, various types of cements became available in Bangladesh which helped the cement industry to provide differentiated and improved products to the customers. The cement which is widely used from the year 2003 is the Portland Composite Cement (PCC) which is made following European Standard Methods (ESM). Holcim (Black Cement) was the first company to launch this type of cement in the market. Currently ratio of production of PPC and OCC is 95:5.

PCC gives equal strength and durability like OPC. The basic difference between them is in the manufacturing technology. Only 65%-80% of clinker is required to produce PCC while 95% of clinker is required to produce OPC. So, worldwide PCC has become popular which

requires less clinker.

The manufacture of cement is a two-phase process. Firstly, Clinker is produced. Most common methodology of producing clinker is to mix up calcareous minerals such as chalk, limestone containing silica and alumina and heat upto 1450 degree C. After cooling it, clinker is formed.

Secondly, the clinker is ground with calcium sulphates and with industrial processes wastes such as blast furnace slag, limestone and fly ash to produce Portland cement. Two basic types of clinker production processes exist, depending on the way the raw materials are prepared before entering the kiln system:

1. Wet method (use in Bangladesh)

2. Dry method

In the wet method, water is added to form wet thick slurry and dry process is based on drying the bulk materials to form a dry powdered meal. The choice of process depends on moisture content of the available raw material. When wet raw materials (moisture content over 20%) are available, the wet process can be preferred. However, in Europe, today’s new cement plants are all based on the dry process as the wet process requires approximately 56% to 66% more energy. For dry processes, current state-of-the-art technologies are kiln systems with multistage cyclone preheaters and precalciners. Each step in manufacture of Portland cement is checked by frequent chemical and physical tests in plant laboratories. The finished product is also analyzed and tested to ensure that it complies with all specifications.

Table 2: Standardization-Bangladesh Cement.

Bangladesh has adopted EN197- 1:2000 as Bangladesh Standard, titled BDS EN 197-1:2003. Under this Standard there are 27 products in the family of common cements, which are grouped into five main cement types as follows:

– CEM I Portland cement

-CEM II Portland- composite cement

-CEM III Blast furnace cement

– CEM IV Pozzolanic cement

– CEM V Composite cement

4. Cement Industries contribution to the Economy

Government would be able to materialize its important ADP. According to the UN Population Fund (UNFPA) report 2010, 28% people of our country live in urban areas where the population growth is 3.2 per thousand. Urbanization and demand for accommodation are increasing day by day. Thus it is expected that the real sector will grow steadily with the household users‟ increasing cement consumption pattern. Private sector may get interested to invest in real estate for getting tax advantages of their undisclosed funds. Good number of large infrastructure construction projects (Padma Bridge, Flyovers, highways) are on the pipeline. Govment can generate foreign currencies from different countries. Different groups are reinvesting their money from cement to other sectors. Thus fund is properly being utilized.

In January 2012, Bangladesh’s Export Promotion Bureau released data confirming that cement exports had witnessed a 21% increase in the first seven months of the current fiscal year (July 2011 – January 2012). Abdul Khaleq Parvez, Vice President of the Bangladesh Cement Manufacturers Association, commenting on the export situation said: “The export market is growing slowly as the prices of local cement increased sharply following devaluation of the local currency.

5. Producers and Consumers of the Industry

5.1. Major Producers of the Industry

The largest 13 cement manufacturers hold 78% of the market share. Heidelberg, Holcim and Lafarge are the leaders among multinational cement manufacturers and Shah and Meghna are the leading domestic manufacturers. Shah cement is the market leader with close to 14.20% of the market share, closely followed by Heidelberg with about 9.30% of the market share. During the 2011, many small local manufacturers like Premier, Seven Circle, Crown, Fresh and King cement increased their sales drastically riding on their benefits of economies of scale, backward linkage and aggressive marketing effort. Source: BCMA

5.2. Major Consumers of the Industry

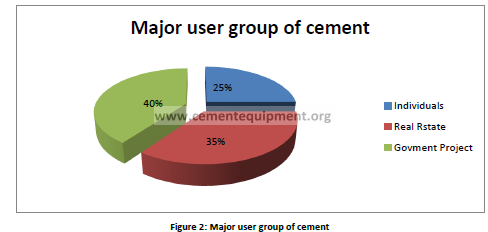

In Bangladesh, the main cement consumers are:

1. Individual home makers (25%)

2. Real estate developers (35%)

3. Govt. organizations, i.e., LGED, RHW etc. (40%)

Real estate developers and Govt. projects are the dominant users of cement. During 2007-2008 public sector construction works were slowed down under caretaker government. Unwillingness to disclose the source of income contributed to the downward trend in real estate sector, i.e., building of apartments, flats etc. during that time period.

6. Cost and Pricing Structure

6.1. Cost Element

To start with, the cost of producing the cement itself is taken into account. This includes the cost of importing raw materials, cost of production and the cost of packaging all inclusive of other fixed costs consisting of inventories and human resource required for production. The market demand also plays a dominant role in the price fixation of cement.

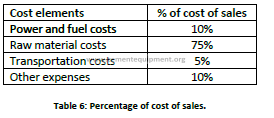

There are a number of cost elements which are taken into consideration for price fixations of cement bags. Four major costs are associated with the production of cement as provided

6.1.1. Power and fuel Cost

Cement industry is power-intensive with power and fuel costs constituting approximately 7%-10% of the cost of sale of cement, and hence has a major impact on the operating expenditure of the manufacturers. 30 KW to 35 KW electricity is needed for producing per MT cement. Though a large portion of the power requirement is met through national grid, increasingly large companies are opting for captive power plants to reduce costs and to have continuous power supply. Currently, 17-18 cement manufacturers got captive power plants.

6.1.2. Raw material costs

The second major component in the production of cement is raw material costs. Main raw material of production is clinker which accounts 70-75% of the COGS. Bangladesh does not have its own supply of limestone and cannot produce clinkers domestically. Except Lafarge, all other cement manufacturers of Bangladesh import clinkers. But currently, even Lafarge is also dependent on imported clinker due to the unavailability of Limestone. About 10-15 million tonnes of clinker is imported annually from abroad.

6.1.3. Transportation cost

The weight/ price ratio of cement effects transportation cost significantly. Location of a cement plant and the cost to transport the cement to its distribution terminals, determines the plant‟s competitive position and price it may charge.

6.1.4. Other expenses

Other expenses include employee costs, administration expenses, others. These account for 5-10% of the cost of sales.

6.2. Pricing Structure

The pricing of cement of various companies are very close to one another. (refer to Market price in Dhaka & out of Dhaka). There are a number of components which are taken into consideration while price fixations of cement bags are carried out.

6.3. Seasonal demand of the product

The other important factor which has an effect on the changing price of the product is that of the seasonal demand of the product in the market. There are mainly three dominant seasons in terms of demand of cement in the cement industry. They are as follows:

– Peak Season: January to April/ May

– Dull Season: June to September

– Off Season: October to December

In the cement industry, January to April which sometimes also stretches till May is considered as the peak season when the demand of cement in the market is very high. As per the climate of Bangladesh, there is little or no rainfall in the country thus it is an ideal 60 times for starting the work of constructing buildings and other infrastructural development projects during this season.

The month of June to September is considered as the dull season in cement industry when the overall sale of cement is quite low compared to that of the peak season. This is the time of the year when rainfall is most evident in our country.

The Off season for the cement industry usually starts from October and ends in December. During this time the sale of the cement is normally the lowest or almost close to nil. This is also the time just before the peak season. From past observations, it has been seen that usually the other materials related to cement (mainly referring to the other building materials) are not available during this time of the year.

6.4. Price of competitor’s products

The pricing of cement of various players in the industry are very close to one another. Due to the presence of homogeneous products in the market, price war is a sensitive issue in this industry which exists from time to time in the cement market. Another component which is taken into consideration while fixing the price of cement bags is done by observing the price of the competitor’s products.

7. Future outlook of Cement industry of Bangladesh

Sales of cement are increasing due to an enormous demand for cement in both the local and foreign markets. The industry realized about 30% and 21% growth in 2010 and 2011 respectively after suppressed demand from previous years.

In addition, the present government of Bangladesh has allocated a huge amount for the Annual Development Project (ADP) budget for the upcoming infrastructural projects of the government to be located in Bangladesh. Some of these big projects which are/have undergone agreements are the construction of Padma Bridge, Elevator Express (4 lane roads between Dhaka and Chittagong) and the construction of a Power Plant for the Bangladesh Power Development Board of these projects would create a huge demand for cement in the market in the near future creating more opportunities for these companies to accommodate their increasing production capacities and to earn profits.

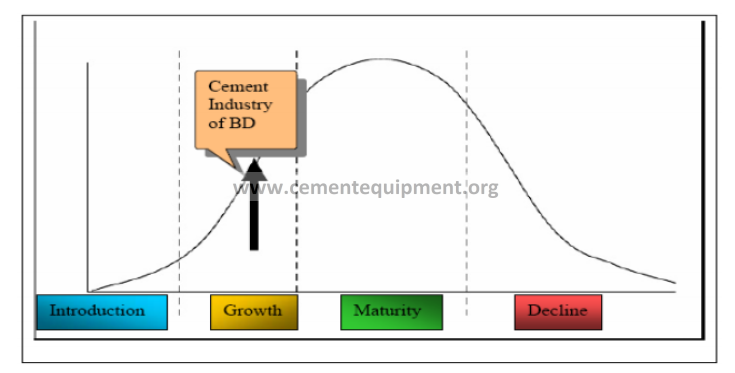

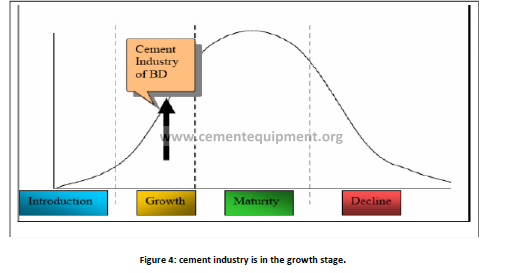

By analyzing all the information mentioned above, it can be said clearly that in the lifecycle of a product (industry in this case), in Bangladesh; the cement industry is in the growth stage currently. This phase of the industry has been illustrated in the graph below.

Industry expected demand growth is 20%-25% for the next three years based on the assumptions below.

1. Government would be able to materialize its important ADP of building big infrastructure projects.

2. According to the UN Population Fund (UNFPA) report 2010, 28% people of our country live in urban areas where the population growth is 3.2 per thousand. Urbanization and demand for accommodation is increasing day by day. Thus it is expected that the real sector will grow steadily with the household users‟ increasing cement consumption pattern.

3. Private sector may get interested to invest in real estate for getting tax advantages of their undeclared funds.

4. Good number of large infrastructure construction projects (Padma Bridge, Flyovers, and highways) is on the pipeline.

5. There is no “Substitute” for Cement. Steel can be used in construction but in limited extent due to its high cost.

On the flip side, some caution has to be maintained due to the current demand- supply gap leading to over capacity and falling margins and prices. Also, given the close linkages between them, the effect of a slowdown in real estate growth or hike in interest rates globally or price increase of imported raw materials should also be considered.

8. Conclusion

Many countries cannot produce enough cement to meet their internal demand, and they depend on imports. However, Bangladesh is self-sufficient in fulfilling local demand for cement. Even so, the installed production capacity is higher than local demand.

In Bangladesh, there are around 55 cement-manufacturing companies, most of which are in operations either on a large or small scale. A total of 34, including multinational cement manufacturers, are in commercial production.

The installed production capacity of the 34 cement factories is 1.85 crore tonnes a year, according to Bangladesh Cement Manufacturers Association (BCMA) data. Although Bangladesh is self sufficient in cement production, it needs to import all the raw materials used in cement manufacturing. The main ingredients for cement include clinker, gypsum and fly ash, which are mainly imported from Thailand, Malaysia, Vietnam and China.

Bangladesh is over capacity. The entire industry and local demand is controlled and fulfilled by the Bangladeshi cement companies. We are self sufficient in cement production and meeting local demand. We don’t need to import cement, not even a single bag.

Pingback: Cement Industry in Bangladesh: Full Overview